How To Stay Debt Free!

You finally made it! You’re debt free and you relish in the glory a bit before anxiety overwhelms you, realizing how incredibly easy it would be to fall back into the trap of debt. You want to loosen the reigns a little but you are determined to STAY Debt Free! How do you make it happen? How do you release the anxiety that has overcome you? Is it possible to STAY Debt Free?

Create A Savings Plan

A Savings Plan will certainly reduce your anxiety of returning to debt. It is the single most important factor, in remaining debt free.

According to Dave Ramsey, once debt is paid off, the next step is to create a 3 – 6 month emergency savings. Calculate how much you would need to live for 3 – 6 months and determine how much you will need to save, each month, to get there.

With emergency savings in place, never again will you have to rely on credit cards and debt, when you find yourself in a tight spot.

Create A Spending Plan

This post contains affiliate links. When you purchase through an affiliate link, we receive a small commission at no additional cost to you. Disclosure.

This is no time to get lazy. Stick with your spending plan or create a new one. There’s no need to get fancy here. A simple ledger book will last you many years!

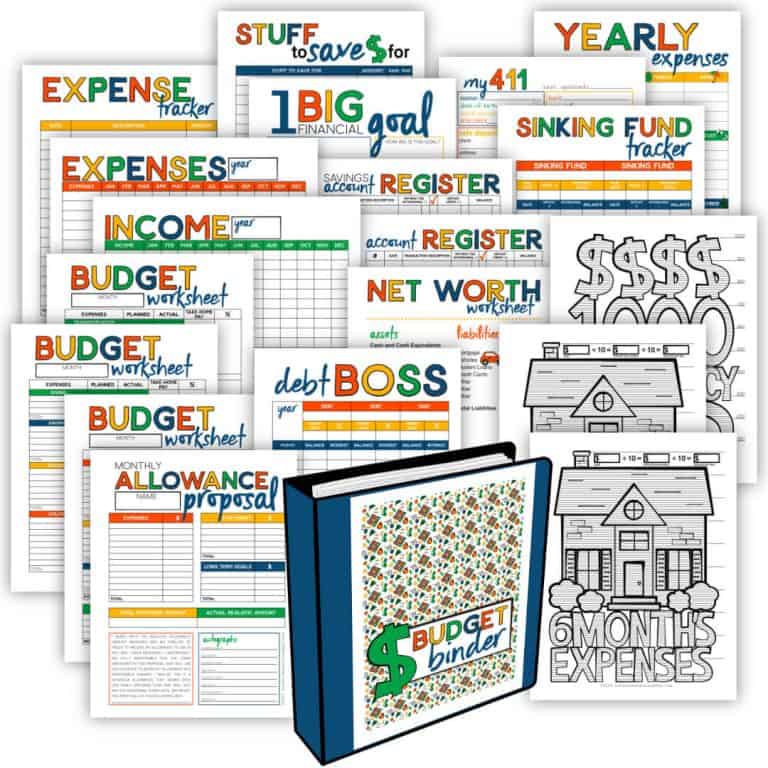

If you prefer printables, you’re in luck! You can find income and expense printables in our Budget Binder!

Simply write in your monthly expenses, as you pay them, and voila! You have a spending plan! Don’t forget your monthly ‘expendables’. We allow a pre-determined amount, each month, for expendables. This includes groceries, gas, dog haircuts, eating out, and anything we would possibly need money for, throughout the month.

Forget Credit Cards

There may be a time when you can safely use credit cards again. Now is not that time.

The rewards may be calling your name but don’t fall for that trap. After all, credit card companies bank on the fact you will fail.

Pay Off Credit Card Transactions Immediately

Let’s face it, there are instances where you just can’t avoid the dreaded credit card. For instance, your monthly Netflix subscription or the online shopping that just makes life easier. If you charge something, make a deal with yourself to go onto your online banking and pay it off immediately. That doesn’t mean when the bill comes. That means the same day you charge, pay it off!

Paying off credit card transactions immediately keeps you in touch with reality. You know you can’t charge if it isn’t in your bank account. You also know exactly where you’re at for the rest of the month and will avoid surprise bills.

How many of us have gotten a credit card bill and been totally surprised by the amount? Am I the only one? Gas here and there, automatic charges, a quick shopping trip? They add up fast and, before you know it, you’re stuck with a big bill.

Live Like You Have Debt

You may think you can afford to hire a house cleaner now and eat out twice a week. Think again. You worked hard to get out of debt. Make it worth it!

Give Yourselves an Allowance

We are big proponents of adult allowances! We’ve used them since our newlywed years and continue to use them, over 20 years later.

Use allowances to give yourself some freedom. Guilt-free freedom to spend on just what you want!

Even though you are debt-free, you might be fearful that you could easily slip back to that place, in a blink of an eye. This feeling may keep you from enjoying life and letting loose. We all have to let loose, once in a while, and your allowance is just the place to do it! Guilt. Free.

It’s time to breathe! It’s time to kick anxiety to the curb and enjoy your debt-free life! You CAN STAY Debt Free!

Create a savings plan, create a spending plan, ditch credit, or if you use it, pay transactions off the SAME DAY, live like you have debt, and give yourselves an allowance!

Put these simple steps in place and rest easy! You got this! I’m cheering for you!

Great tips! We finally stayed debt free by not having credit cards at all. I use my debit card for bill paying and cash for everything else. I wish I could get into those credit card rewards program thingies but I just don’t trust us enough not to get into trouble again. I don’t ever want to see another loan again, not even the “good kind” (a.k.a. in the PF world ~ mortgage). 🙂

Oh, Kay! I hear ya! We will have a mortgage again soon and I’m not looking forward to it. Blech!