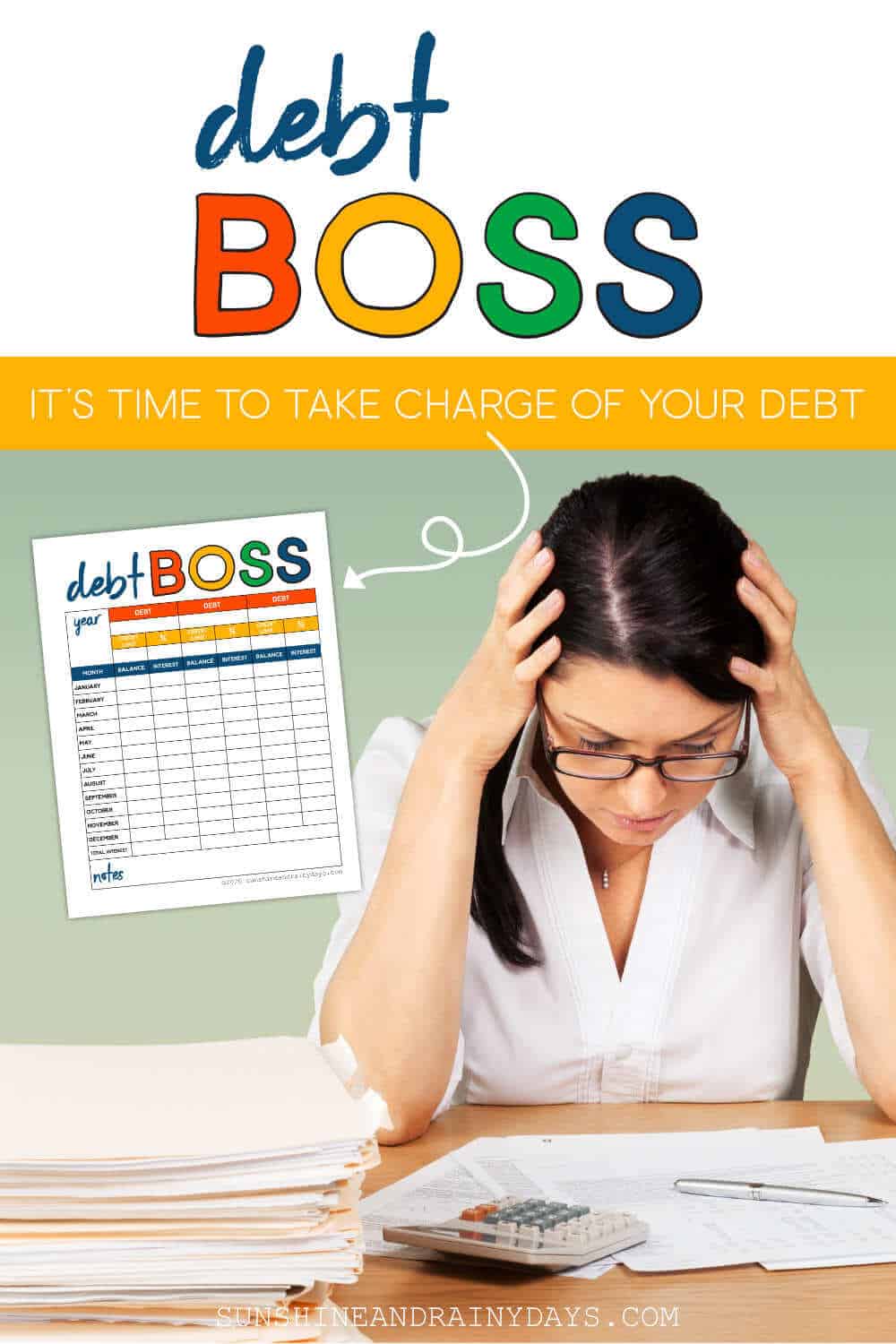

Debt Boss Debt Tracker – Take Charge Of Your Debt Now!

When your credit cards get out of control, it can take a while to get back on track. The Debt Boss debt tracker will give you a visual of where you’ve been and, hopefully, a positive outlook on increasing your overall net worth!

Having a visual of exactly how much you owe is an excellent motivator to stay on track. Little bits of scratch paper with amounts owed and interest paid will work but the Debt Boss will keep you organized, at a glance.

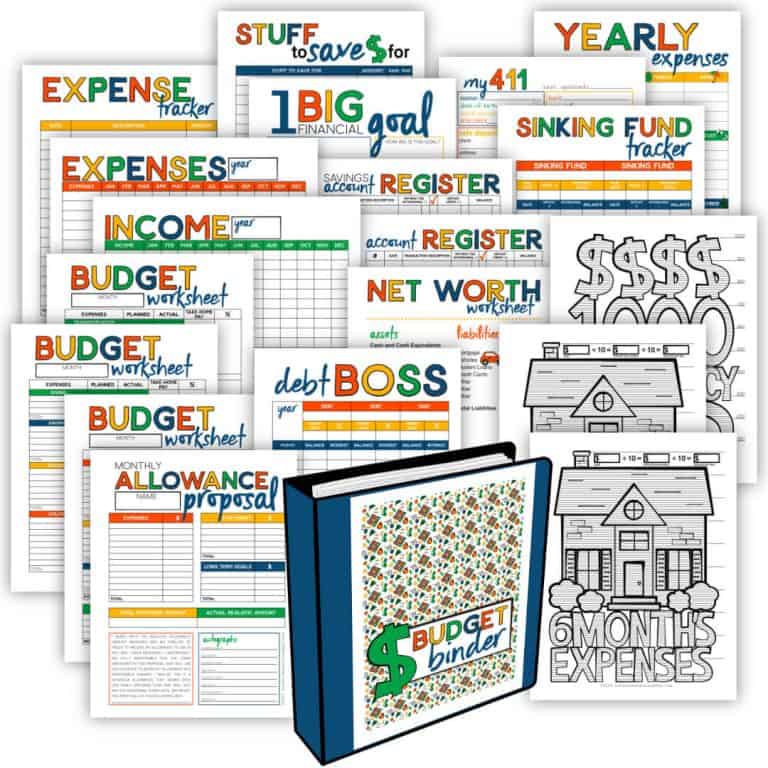

What’s On The Debt Boss Worksheet?

Creditor

The Debt Boss provides 3 columns to record up to 3 debts. If you have more than 3 debts, print as many Debt Boss sheets as you need. This isn’t just for credit cards, list your mortgage, car payments, and any other debt that has an end point, too.

Credit Limit

It’s always good to know if you’re close to your credit limit and to keep tabs on your credit to debt ratio.

Did you know if your balance is over 30% of your credit limit, it can affect your credit score? For example: If your Visa has a credit limit of $10,000 and you have $4,000 charged to it, it may affect your credit score.

Interest Rate

The interest rate on each debt is good to know, when paying down debt. Whether you use the Snowball Method or the Debt Avalanche, keep an eye on your interest rate.

Snowball Method

The Snowball Method tackles the smallest debt first, and pays it off, while paying the minimum on all other debt. It then rolls that money over to the next smallest debt, building momentum.

The Debt Avalanche

The Debt Avalanche tackles the debt with the highest interest rate first, while paying the minimum on all other debt. After the highest interest rate debt is paid off, the Debt Avalanche then puts that money toward the next highest interest rate debt, until each debt is paid.

Monthly Balances

Monthly balances are important to keep track of from month to month to ensure those balances aren’t creeping up. At first they may not move much but, eventually, you should see them taking a downhill slide.

Monthly Interest Paid

There’s nothing that motivates you more than seeing how much interest you’re paying on your debt each month. Write it down!

The Debt Boss eliminates all those pieces of scratch paper and shows you your debt, at a glance. There’s no need to prolong the process.

There IS good reason to keep the Debt Boss at your fingertips to encourage you in your debt pay off journey.

Be a Debt BOSS!

Free Debt Boss Worksheet

Take charge of your debt now!

You need a visual of exactly how much you owe and the interest you pay each month, to motivate you to do something about it! The Debt Boss Worksheet is here to help!

Having a visual of exactly how much you owe is an excellent motivator to stay on track. The Debt Boss will help keep you organized, at a glance.

Join The Sunshine Club! As a member of the Sunshine Club, you will receive a Weekly Newsletter where I attempt to share relevant ideas, printables, and even a few freebies!

By subscribing, you are agreeing to our Privacy Policy .

When the credit cards get out of control, it can take a while to get back on track. The Debt Boss debt tracker will give you a visual of where you’ve been and, hopefully, a positive outlook on where you’re going! It’s time to Be The Boss of your debt!

This is perfect for a minimalist! I like things consolidated. 🙂

Thanks for this. Now tracking debt will much more organized..