How To Determine A Fair Allowance Amount

You’ve come to grips with the fact that you need to incorporate an allowance for each family member in your spending plan but how do you determine a fair allowance amount?

Healthy money talks should be a part of every relationship! Tough negotiations included!

What Is Included In A Fair Allowance Amount?

When determining a fair allowance amount, why not factor in regular expenses and put the reigns in each of your own hands?

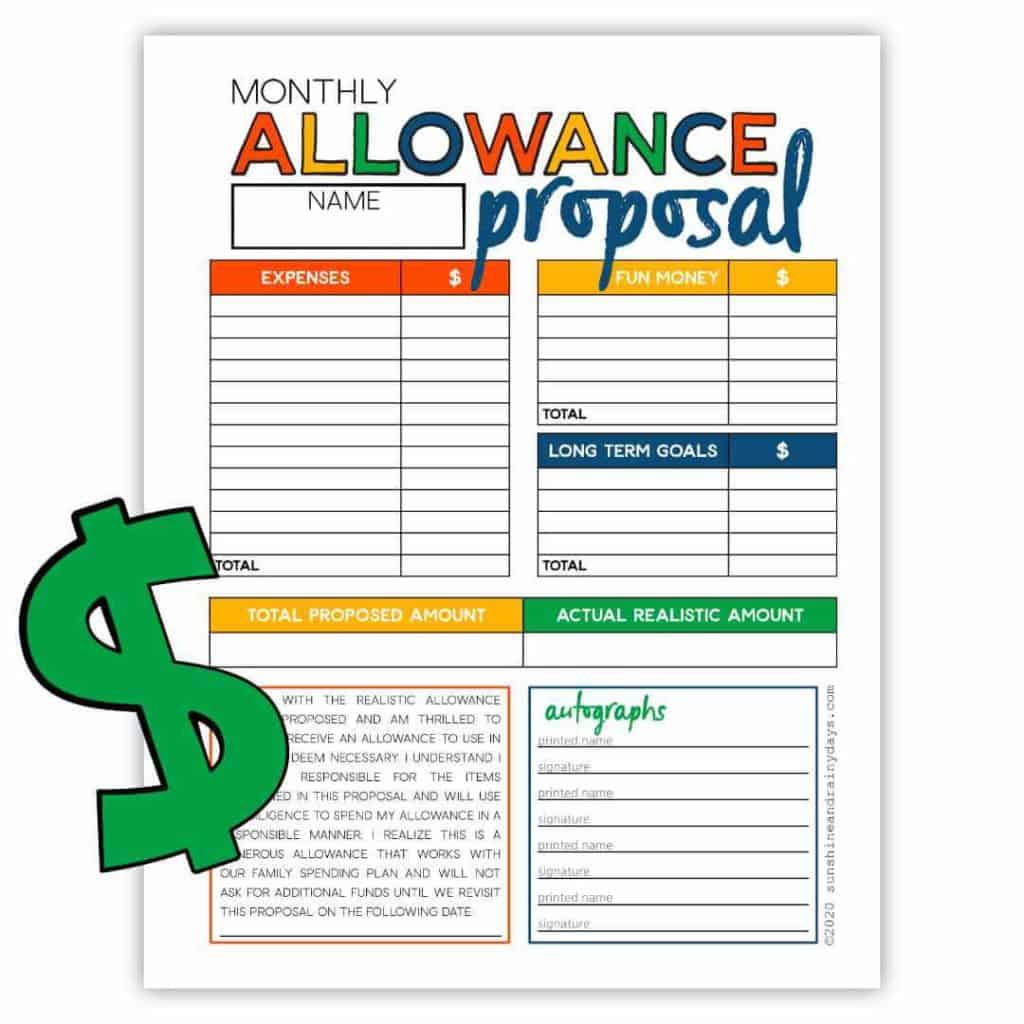

Each family member should determine how much money they need each month for personal expenses, fun money, and long term goals.

Recurring personal expenses, you pay for every month out of the family budget, could easily be incorporated into an allowance.

Expenses

Gas

Add gas expenses from the last three months and divide by three. This will give you a good idea of how much should be allotted for gas.

Haircuts

We all need haircuts once in a while, unless you’re like my son, who couldn’t fathom spending money on cuts and states he’s growing his hair long enough to have a man bun.

Clothes

This is a tough one! It’s easy to make do with what you have but, realistically, there needs to be allowance for something new every so often.

We tend to purchase school clothes at the beginning of the year from our family spending plan and anything else needed throughout the year is purchased through allowances.

Co-Pays

Heading out to the doctor, chiropractor, or massage therapist? Picking up your monthly subscription? You may want to consider including these amounts in your allowance!

We do not include co-pays in the teenagers allowance or they’d never go to the doctor!

This post contains affiliate links. When you purchase through an affiliate link, we receive a small commission at no additional cost to you. Disclosure.

Car Maintenance

You may want to consider lube oil filters in your monthly allowance. If you take your vehicle to a car wash every so often, that amount could be considered as well.

Nickel And Dime

This is a biggie, especially if you are in the workplace. There seems to always be something to donate to or events to contribute to. This is especially true for my husband, who works in public education. Every time I turned around, there was something he needed $10 for.

Fun Money

Gifts

Nothing can throw the family spending plan off faster than unexpected gifts that need to be purchased. Make an allotment for gifts in your allowance and keep the family spending plan intact!

It’s much more appreciated when the hubby comes home with a gift he spent his own allowance on! The teenagers also have their own money to purchase gifts for their friends’ Birthday parties as well as family members!

Going Out

Whether it be your favorite coffee stand or having lunch with the ladies, going out money gives you freedom!

Long Term Goals

Is there something big on your want list? Something that you would not incorporate into the family spending plan? Here’s your chance to save for it with your very own money! Money that is off limits to criticism from other family members!

My husband has a gun fund, my son has been saving for the Nintendo Switch, Justine is a saver, and I would love a beautiful DSLR camera!

These are personal long term goals where the purchase will benefit each individual family member. You will have other long term goals that benefit the entire family and those would not be included in your allowance.

How To Determine A Fair Allowance Amount

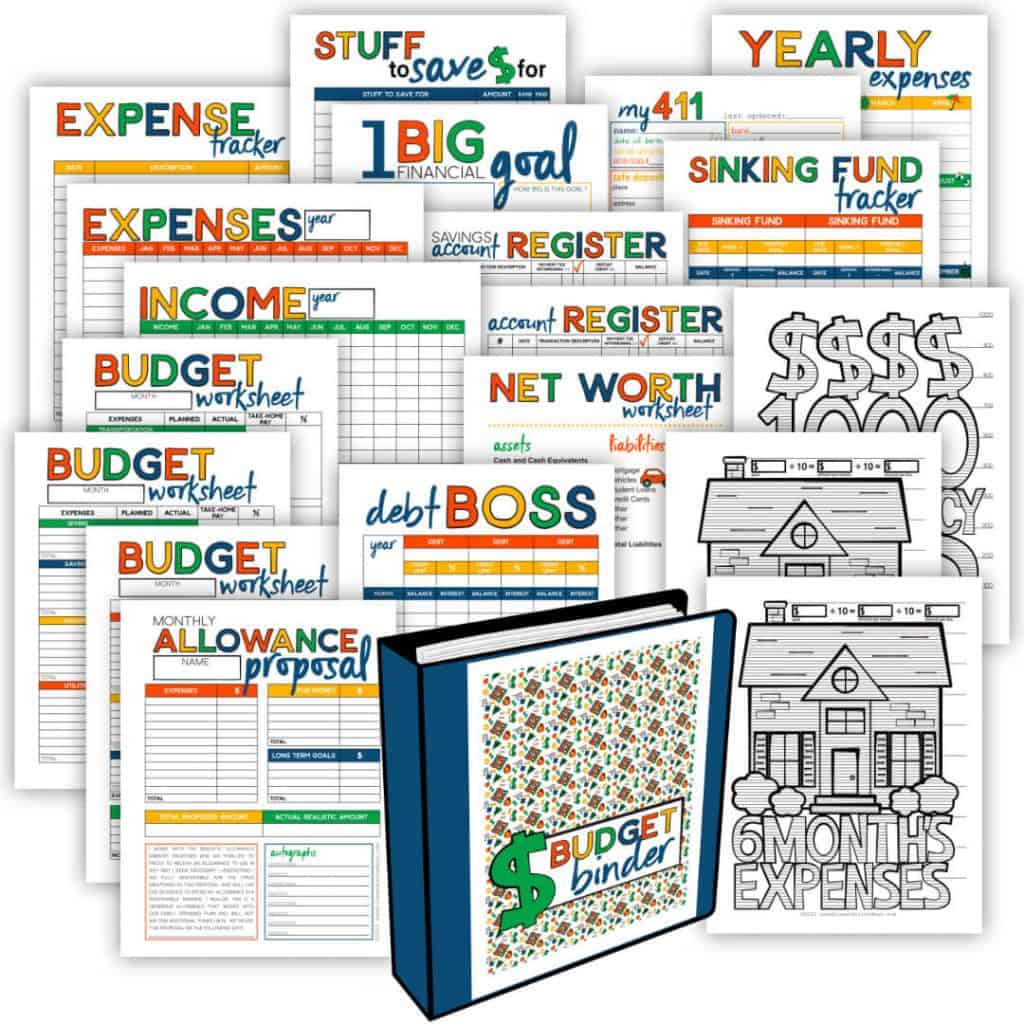

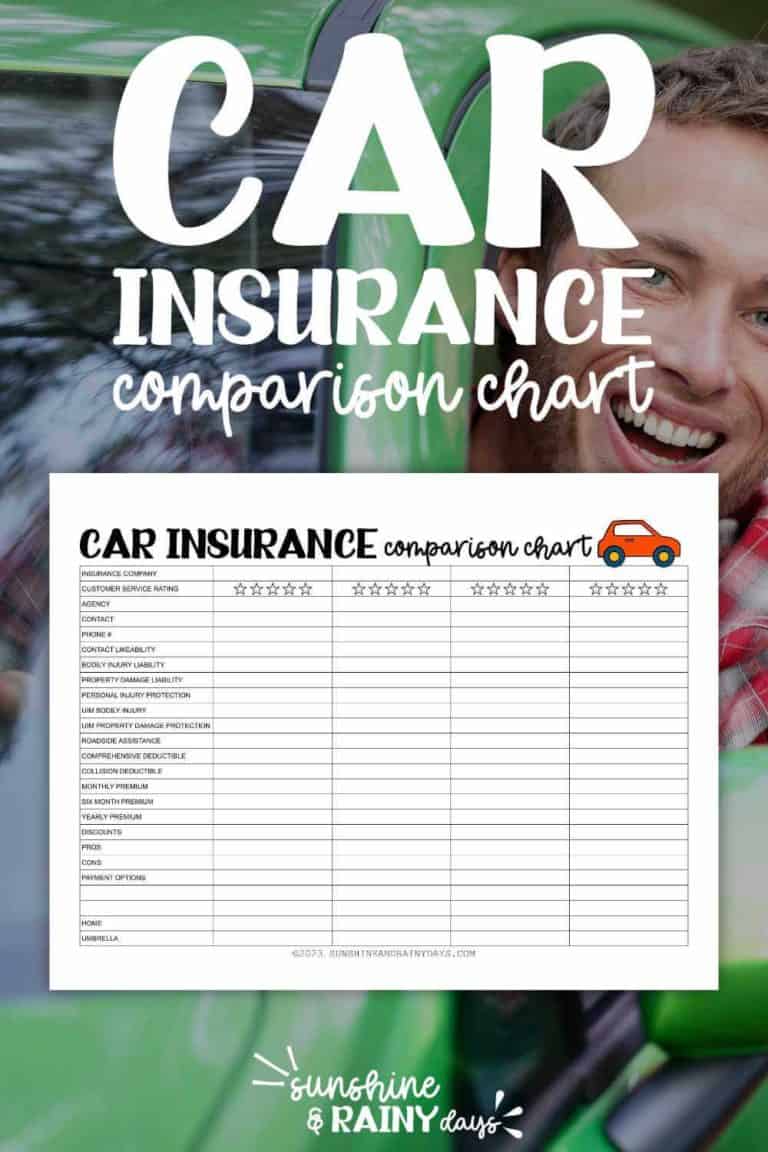

Print the Monthly Allowance Proposal

Calculate your proposed allowance amount using our Monthly Allowance Proposal.

Have A Sit Down With Your Family

Sit down with your spouse and kids to determine what your family spending plan can meet for each of you! The number you come up with should work with your family spending plan yet also be realistic for the needs of each family member.

Sign Your Allowance Proposal

When everyone is on board and in agreement, each family member will sign the Monthly Allowance Proposal in order to keep each other accountable.

What Is The Benefit Of A Fair Allowance Amount?

Simplifies Your Family Spending Plan

With a fair allowance amount in place for each family member, you will no longer concern yourself with costs that pop up throughout the month. You have a plan!

Gives Family Members Freedom

Jack may choose to grow a man bun instead of paying for monthly haircuts and that’s okay! Justine may want to attend church camp and she has money to make it happen!

Steve can stop by the espresso stand guilt free and I can pick up that purse I’ve been wanting without feeling like I’m hurting the family spending plan!

We all make choices and our spending habits reflect those choices.

Teaches Kids How To Budget

If the teenagers spend every last penny as soon as they get it, they know they may have to miss out on a Birthday party or event later in the month for lack of funds. This can be so hard to watch and it would be easy to bail our kids out but stand strong! These are lessons we want our kids to have when the consequences are small.

When you put the reigns in the hands of each family member to negotiate a fair allowance amount, you take one step forward to simplify your family spending plan!

Family members are able to take control of personal monthly expenses, have a little fun money, and save for long term goals!

Kids learn how to negotiate and live within their means.

Adults have personal, no nag funds. That’s a marriage saver right there!

Print your Monthly Allowance Proposal and let the negotiations begin!

More Allowance Posts

My Favorite Allowance Resources

The Big Book Of Everything For Teens – This is a great place to keep your Monthly Allowance Proposal!

How To Make A Duck Tape Pouch With A Zipper – This is a fun way to categorize your allowance!

Thank you for your article. I can agree, that while determining the fair allowance amount you should look at your expences first. Often there are so many hidden payments. Sometimes, while doing this work you can find great ways to lower your expences.

Setting up finances this way is certainly an excellent way to teach children how to budget! I know from a comment you posted on Six Figures Under that you believe in tithing. I’m curious as to how/if you have your kids factor this into their allowance. I’m also a PK who was taught at an early age to give back to our church.

Hi Lucy! It’s fun to chat with a fellow PK’er! We do not ask our teenagers to factor tithes into their allowance as it is their choice how they spend their allowance! Something even more interesting is going on here though! My husband prefers to watch our church service online and we have been doing that for a few years now. My kids, however, have hooked up with a local youth group and go to church on their own! They WANT to go to church! My son also recently sold his LEGO collection and plans to tithe on the amount he sold them for. We did not suggest it. He WANTS to tithe!

We aren’t the parents that require our teenagers to go to church or tithe. Those are things they need to decide for themselves. Oh boy, I will probably get heat for this one!

That is great that your kids want to do these things on their own! I think there comes a time when you do need to let kids decide for themselves…I won’t tell your dad if you don’t tell mine! LOL

This is such a great idea Bridget! Stress free spending, especially for teenagers, is a great gift for all of the reasons you stated. As always, I love your printables! 🙂

Yes! It’s also stress free for me because they have their very own budget! Yay! Printables are so fun to create!