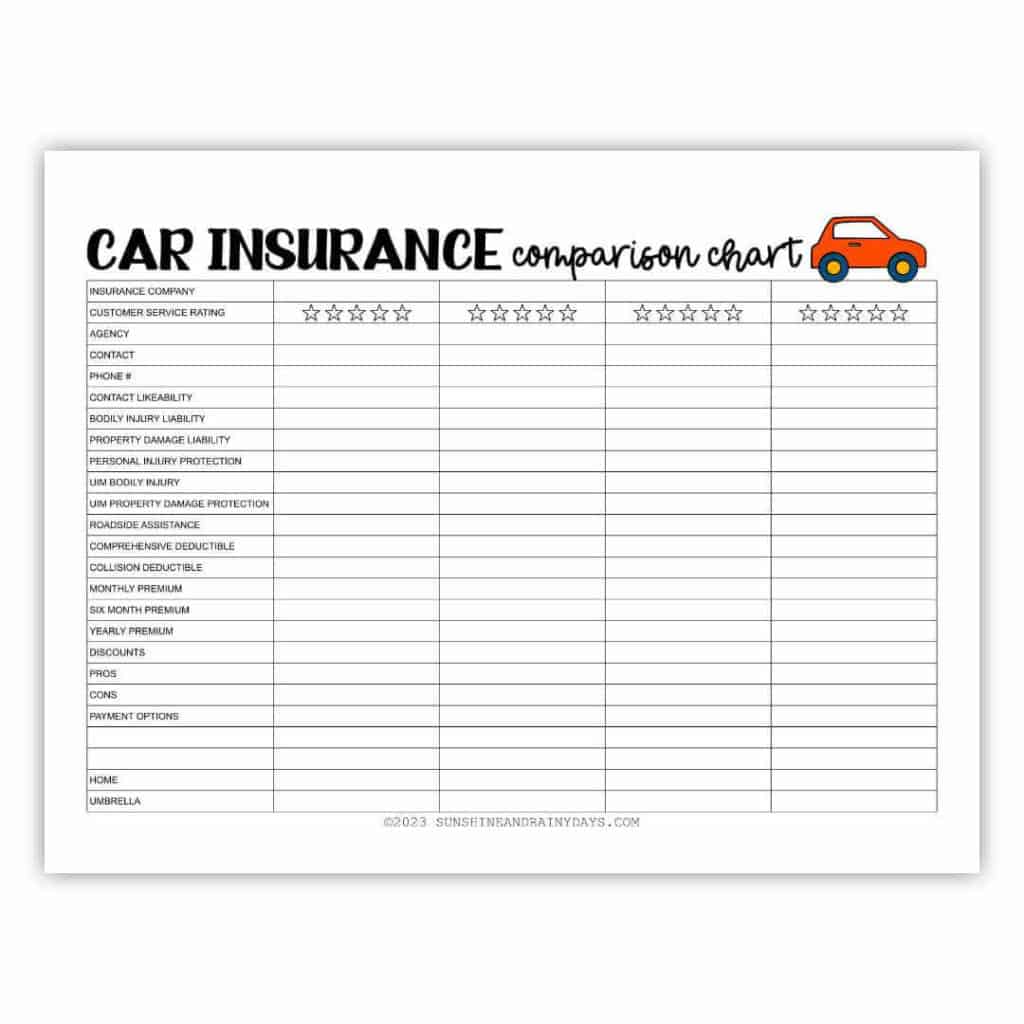

Car Insurance Comparison Chart

This Car Insurance Comparison Chart was designed to help you get the correct information all in one place so you can make an informed decision on the car insurance that is right for you.

When your car insurance rates rise, it’s a very normal and good idea to do a little comparison shopping to make sure the insurance you have is the insurance you want to keep.

Our car insurance increased exponentially, so we decided it was time to check to see if rates were rising across all insurance companies or if we could find a better rate. I ended up with pieces of scratch paper all over the place as I talked to different insurance agents, so I created a chart to help me see the highlights of each company. Of course, there are other things to consider, but I’ve included the basics to help you decide if you are also car insurance shopping.

Why should you use a car insurance comparison chart?

- To Find The Right Coverage For You – This car insurance comparison chart can help you compare up to four different policies side by side and see which one offers the coverage you need.

- To Compare Prices – Car insurance rates vary widely from one insurance company to another, so a comparison chart can help you find the best price for the coverage you’re looking for.

- To Save Money – Using a comparison chart, you may see a policy that provides the same coverage as your current policy at a lower price.

- To Give You A Clear Picture – A comparison chart will give you a place to write all of the important information in one spot so your decision-making is easier.

- To Avoid Frustration – When it comes time to make a decision, you’ll have all the information you need to contact the right agent. You also won’t have to keep track of and try to compare different insurance quotes that may be hard to interpret.

- So You Have A Place To Record Information – You may call different agents and want to write in the information they tell you. Banish the pieces of scratch paper for an organized way to keep the information you need.

- So You Know What To Ask – When comparing different companies, it’s important to compare policies with the same coverage and deductibles. You’ll also want to get the same information for each company. For example, if you know Company A gives a discount if you pay for a year in full but don’t know if Company B does, you will have a more challenging time making an informed decision.

Using a comparison chart will give you the confidence that you’ve done your due diligence in finding the right insurance company for your needs.

This comparison chart includes the following information:

There is room to include information from four car insurance companies on one sheet. Want to check around with more insurance companies? Print more than one chart! I suggest including your current insurance information on the chart as well for easy comparison.

- Insurance Company – List the name of each insurance company you are comparing.

- Customer Service Rating – Find a reputable source and check the customer service rating for each insurance company.

- Agency – Often, a broker can help you find the best insurance rate within a group of companies they offer. Be sure to write which agency you’ve called so you know who to call if you choose to go with them.

- Contact – Even though an agency may be named Fred Scott Insurance, you may talk to an agent that works for Fred. Write their name.

- Phone # – Because you want to call the right person when you make your decision.

- Contact Likability – You may find that you don’t care for an agent, and that’s okay. I used words like friendly, helpful, or even annoying on my chart. To me, it’s annoying when an agent slams other companies or uses fear tactics as a hard sell. Include that in your decision-making process.

- Coverage Options – Detail the amounts of coverage each insurance company offers, like bodily injury liability, property damage liability, personal injury protection, uninsured motorist bodily injury, uninsured motorist property damage protection, and roadside assistance.

- Deductibles – List the comprehensive and collision deductible amounts each insurance company offers.

- Premiums – Record each insurance company’s monthly, six-month, or annual premium costs.

- Discounts – Detail discounts, such as safe driver, good student, and multiple car discounts. One insurance company I talked to gave discounts if each driver installs an app on their phone that shares driving practices with the insurance company. It shows the hours of the day you drive, if you brake hard, how fast you drive, etc. You can also install a device on your car that relays how many miles you drive for a low mileage discount. These discount options seem a bit invasive to me, but it’s good to know your options.

- Pros and Cons – Is there something that sticks out to you that you like or as a big negative? This is the time to record that information to help you decide.

- Payment Options – List the ways that each insurance company accepts payment. I’m finding that many will only accept monthly payments with automatic withdrawals from your checking account or charge an extra fee to take automatic payments from a credit card. These are good things to take into consideration.

- Homeowner’s Insurance – When you package homeowner’s or renter’s insurance with your car insurance, you may receive a bundled discount.

- Umbrella Insurance – Umbrella insurance is another thing to take into consideration.

Including this information on your car insurance comparison chart will help you decide which insurance company is best for you.

What you shouldn’t share with an insurance agent.

It’s always good to share your current car insurance coverage so you can easily compare one policy to the next; however, I have a few opinions on how much information is too much.

In making calls to different insurance agencies, a few agents asked me to share the screen of my current insurance or to email them copies of my current policies. I refused to do so, which seemed to surprise those agents. One agent tried to use scare tactics on me and disparaged my current insurance company. He continued to email and call me twice after the original phone call. It felt icky. I learned from that and now tell any agents who want access to my current policies that I’m happy to relay coverages but other than that, I am only looking for their quote. It’s not my goal to have competing insurance companies pick each other apart and disparage one another. I just want the quote.

Another thing to keep in mind is that insurance agents will log into Zillow or Redfin to get information on your home so they can give you a homeowner’s insurance estimate. Our home still had pictures on those sites from when it was listed for sale years ago. It was a bit weird to have an agent go through your home room by room and talk to you about the spaces in your home that they see online. After a few phone calls like that, I chose to remove those pictures from those sites. It’s probably generally safer not to have photos of your home online that anyone can see.

Get your car insurance comparison chart here!

Using a car insurance comparison chart can help you save time, money, and effort in finding the right car insurance policy that fits your needs and budget.