Break Bad Money Habits

It’s time to Break Your Bad Money Habits! We all have room for improvement, right?

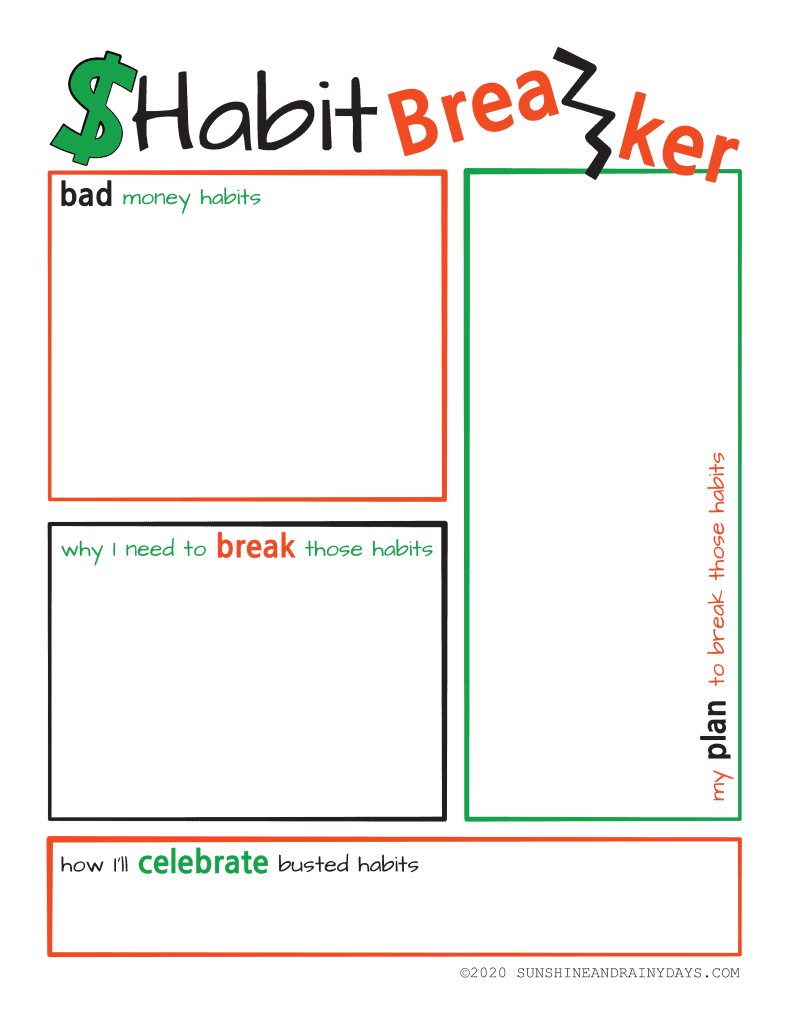

I got an email the other day from Bob at SeedTime and, in his email, he talked about Bad Money Habits. A lightbulb went off in my head and I knew Bad Money Habits were worksheet worthy. I set to work and the Habit Breaker Worksheet was born!

Bad Money Habits

Are you ready to BUST Bad Money Habits that have crept into your life?

Do you know what those Bad Money Habits are?

The possibilities are endless but we will attempt to name a few Bad Money Habits to see if they resonate with you.

Pay The Minimum On Credit Cards

You know this. I really don’t have to say it, do I? When you pay the minimum on your credit cards, you end up paying WAY more for everything you charged. WAY more!

Pay your credit cards in full each and every month and make them work FOR you!

Spend More Than You Earn

We have to have everything and we HAVE to have it NOW, right? That’s how you end up spending more than you earn. Don’t do it.

Come up with a spending plan and stick to it. Even IF your favorite musician will be in town and you have to buy the tickets NOW in order to go.

Buy Stuff You Don’t Need

- Are you in the habit of treating yourself every payday?

- Do you head to the mall every Saturday like clockwork?

- Is a stop at McDonald’s on your daily agenda?

- Do you go into the convenience store to buy a Slurpee every time you get gas?

Stop the madness! You may not think of the things you do on a daily basis as bad money habits because they are so ingrained in your every day.

It’s time to go over your daily habits and decide which ones aren’t doing you any favors.

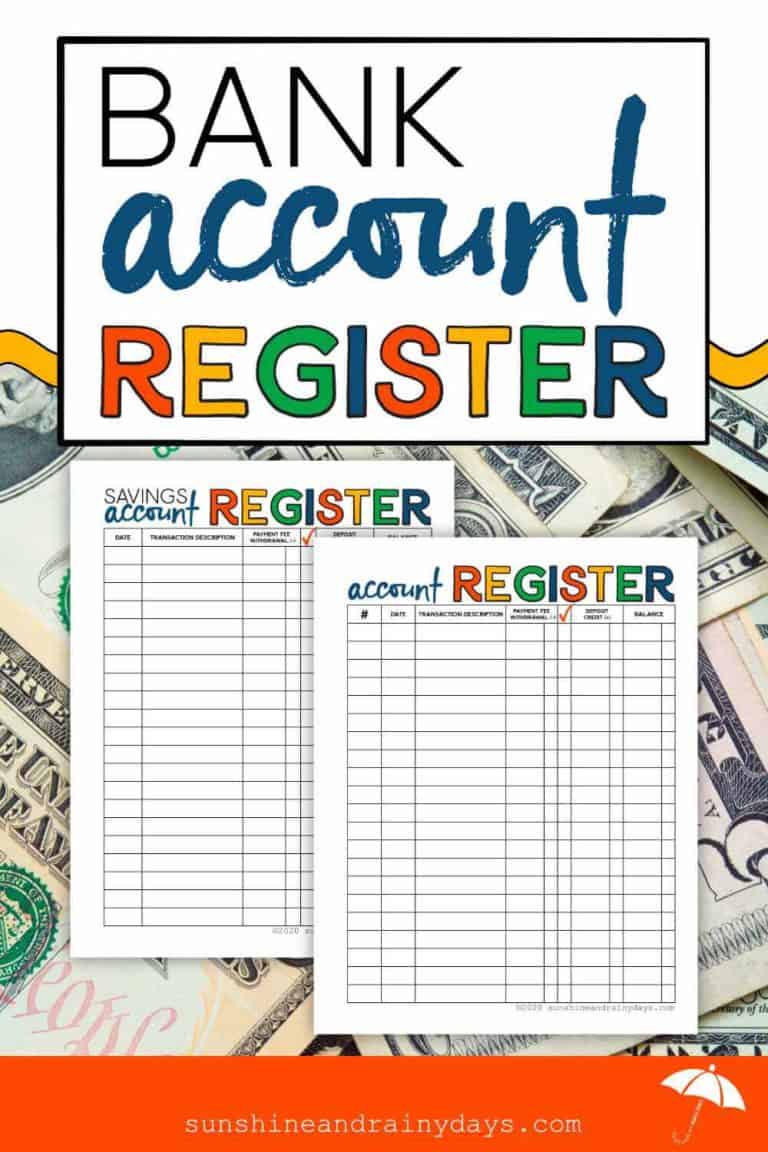

Have No Idea Where Your Money Goes

You don’t need a huge system to track your money. Really, you don’t! Keep it simple and KNOW where your money goes.

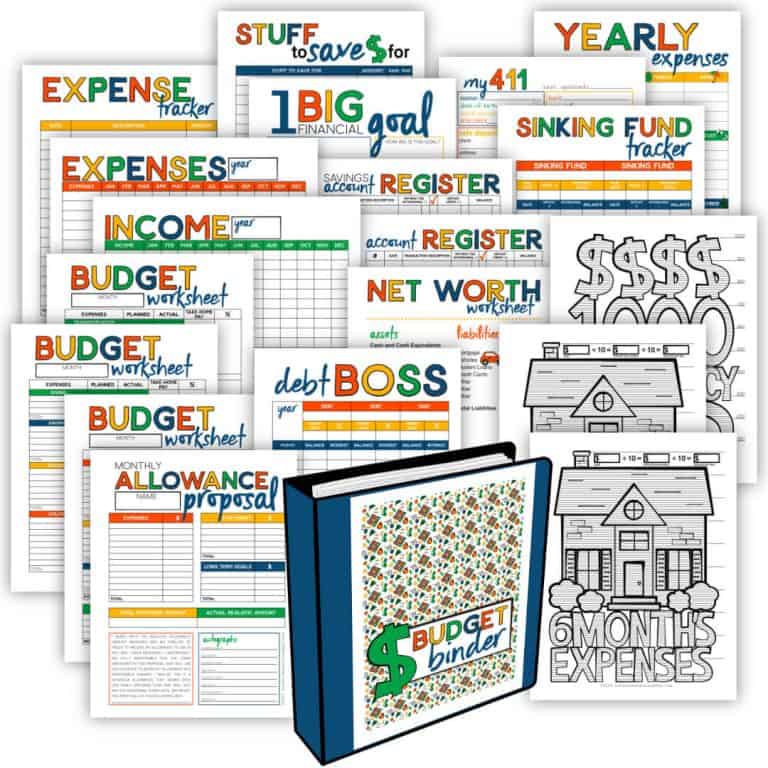

Our Income and Expense Printables will help you do just that!

Pay For Subscriptions You Don’t Use

Can I get on my soapbox, here? I tell ya, EVERYONE is jumping on the subscription bandwagon. Subscriptions are the way businesses keep the money coming in month after month. They don’t want to sell you just that one thing you need, they want your money every month. AND a lot of folks give it to them.

Re-evaluate your subscriptions and, if you aren’t using it, get rid of it!

Do you recognize yourself in any of the above scenarios? Maybe there’s another bad money habit you have OR maybe you’ve already busted those bad habits?

If you do have bad money habits to bust, keep reading!

How To Bust Bad Money Habits

Don’t you love it when you’re told a problem but not given any real solution? It happens ALL THE TIME! But not here!

We have a Habit Breaker Worksheet to guide you in busting those Bad Money Habits!

- Print the Habit Breaker Worksheet – found below.

- Acknowledge your Bad Money Habits.

- Write your Bad Money Habits on the Habit Breaker Worksheet under ‘bad money habits’.

- To have success in breaking Bad Money Habits, you must have a reason WHY you need to bust those habits.

- Write your why under ‘why I need to break those habits’.

- Decide action steps you will take to bust those bad habits.

- Record those action steps on the Habit Breaker Worksheet under ‘my plan to break those habits’.

- Busting Bad Habits is hard work! Plan a reward for yourself once your Bad Habits are successfully busted! Some people say it takes 21 days to form a habit, while others say it takes 66 days. Play it safe and plan your reward after two months of habit busting success!

Busting Bad Money Habits starts with a Change of Behavior. One step at a time. You got this!

Get Your Habit Breaker Worksheet Here!