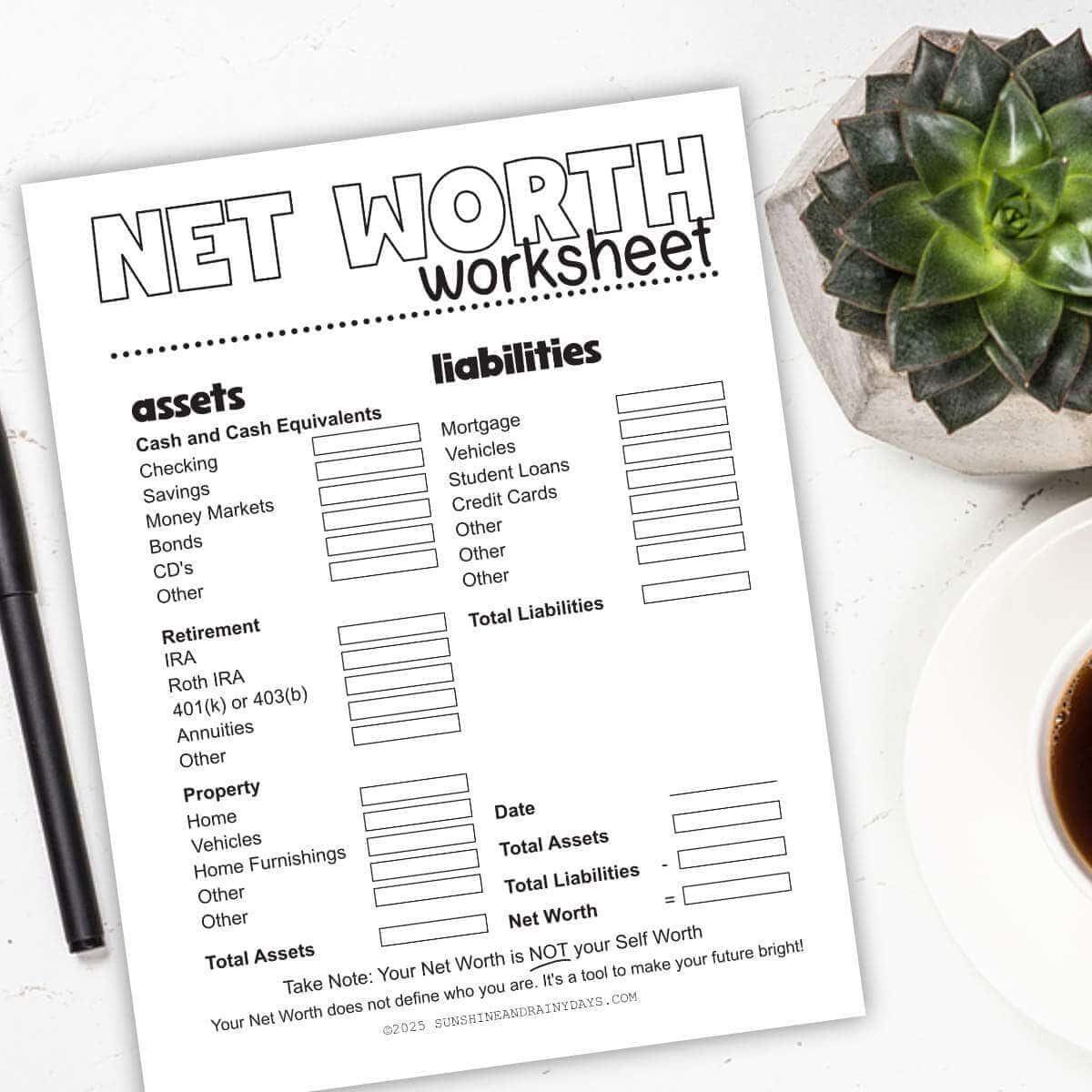

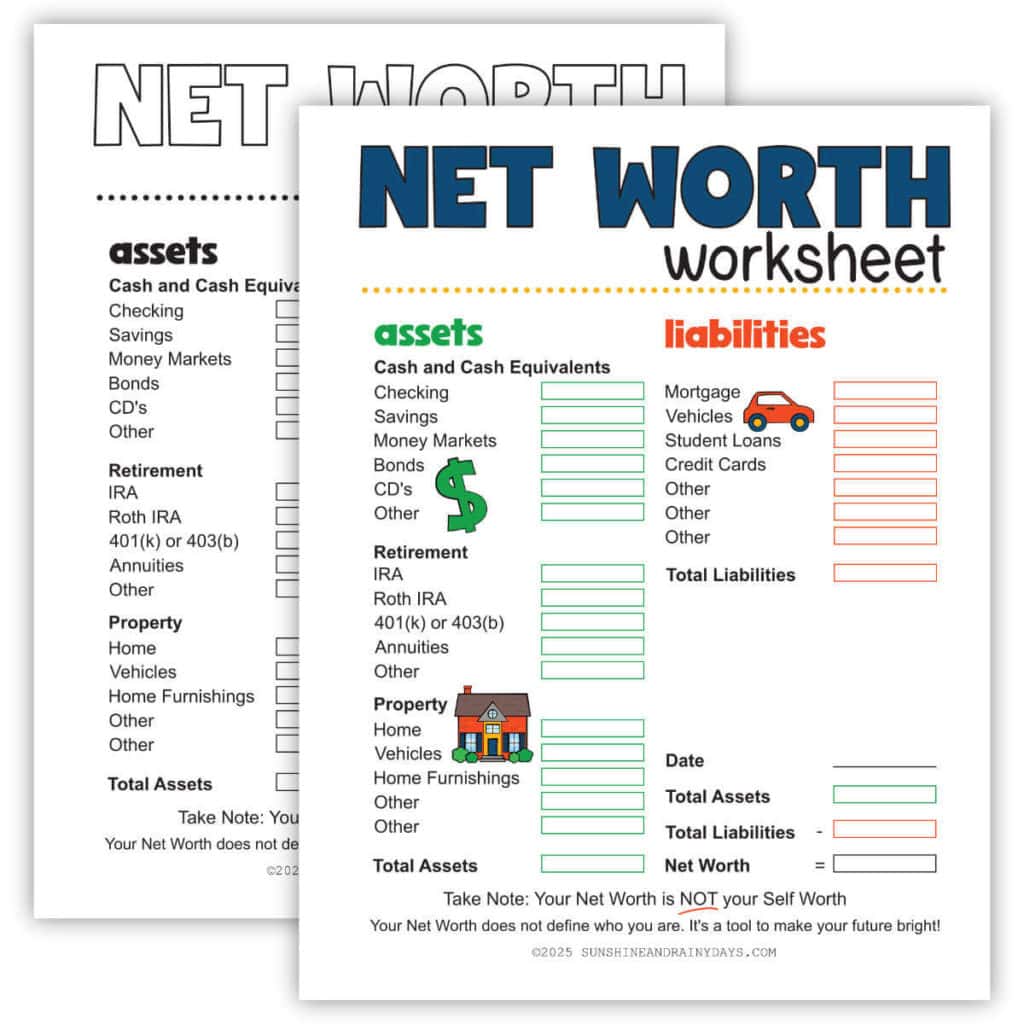

Net Worth Worksheet

Tracking your net worth is the first step toward financial freedom. It’s not just about crunching numbers, it’s about understanding where you are today so you can guide your financial life to where you’d like to go. Whether you’re planning for retirement, building wealth, or seeking peace of mind, calculating your net worth gives you clarity and motivation to reach your goals. Our simple Net Worth Worksheet lets you easily track your assets and liabilities and work towards financial freedom.

We complete a simple net worth check yearly. It is just the basics: retirement accounts, home equity, outstanding mortgage, etc. We do this to keep our eyes on retirement. We don’t have a set age that we know we will want to retire, but we want to be prepared. By tracking our net worth, we keep our eyes on the prize, a retirement without financial worry.

This post contains affiliate links. When you purchase through an affiliate link, we receive a small commission at no additional cost to you. Disclosure.

What Is Your Net Worth?

If you have never asked yourself this question, or maybe it has just been a while, you should. Don’t be afraid! You may be worth more than you think. With a few simple calculations, you can find your net worth.

How Much Should Your Net Worth Be At Retirement?

How much should your net worth be? That’s a great question, and the answer depends on your lifestyle and where you live. Our goal is to retire with a net worth of $1.5 to $2 million, and we believe it’s within reach. You can also try out this Retirement Planner Calculator to give you a general idea of what to aim for.

How To Use The Net Worth Worksheet

- Print the Net Worth Worksheet – found below.

- Record your assets. Assets are anything that you own. This worksheet includes space to include the worth of your home and vehicles. Kelley Blue Book will walk you through the steps to discover how much your vehicles are worth and Zillow is a good starting point for the current worth of your home.

- Record your liabilities. Liabilities include any debt you owe. Your mortgage, student loans, car loans, and credit card debt.

- Subtract your liabilities from your assets to find your net worth. If your assets total $500,000 and your liabilities are $300,000, your net worth is $200,000.

- Use the Net Worth Worksheet every month, quarter, or year. You decide!

Why Do I Need To Know My Net Worth?

There’s no way to know exactly how wealthy you are without knowing what your net worth is.

Lissa Poirot – Moneywise

To make sure you’re on track for retirement.

When you know your net worth, you know what you need to do before you retire.

For peace of mind (or a kick in the pants).

If you don’t know your net worth, you don’t know if you’re prepared for the future. Give yourself peace of mind! You might be worth more than you realize. If not, you know it’s time to get busy.

To gain motivation to save.

When you start tracking your net worth, you gain motivation to save and watch your net worth grow even bigger!

To become aware.

It’s super important to be aware of your financial worth. There’s no better way to do it than by calculating your net worth on a regular basis!

How Can I Improve My Net Worth?

There are two main ways to improve your net worth. Those are through decreasing debt and earning more.

Decrease Debt

When you decrease your debt, you increase your net worth. Many of us find ourselves with credit card debt, student loans, and car loans along with a hefty mortgage payment. I suggest using the Debt Boss to track your debt and motivate you to do something about it.

Earn More

Easier said than done, right? But, in order to increase your net worth, it’s important to look for ways to earn more. Whether that’s through a part-time job, side hustles, or investments, the possibilities are endless to help you earn more. Even if your regular nine-to-five provides a sweet salary, don’t be afraid to take on side hustles that don’t match your current salary. Every little bit helps.

It’s time to calculate your net worth. Use our Net Worth Worksheet to calculate your net worth and work hard to build a future that you’ll love!

Frequently Asked Questions

Hi! I’m Bridget!

I create printables and DIYs to help you get organized and celebrate special occasions! It’s my mission to inspire you to get creative and find joy in every day!

I truly believe keeping track of your net worth is a great way to motivate yourself to better your financial future.

I enjoyed this article and hope to see you both at the beach as I bake in the sun enjoying my Corona, lol

I’m looking forward to checking out your net worth reports, Michael! Enjoy that beach!

Good job on the net worth. IS numbers a mac app only? I don’t own apple products. 350K will turn to 1 million in no time. Good Luck.

We’re hoping for that million;0) Numbers is a Mac product. I’m thinking Excel must have the same type of thing though!

This is a great idea! Periodically assessing one’s net worth. I think I’ll make this a new goal. Thanks! 🙂

You are so kind Kay! Thank you for your positive words!

I’m not sure this post is helpful seeing as you never actually explain how to calculate ones net worth, you just state your own?!?

Thank you for the feedback Andi. I’m sorry the post was not useful to you. I will see if the hubby can expand on the post to clarify. In the meantime, the handy dandy chart I created will give you a great idea of the assets and liabilities we used to figure our net worth. Of course, yours will probably be different as we all have a wide variety of assets and liabilities.

I think it’s good to keep tabs on this, to know your overall financial situation. Not sure how often others do this, but I assess net worth at least every quarter.

Finding your net worth definitely shows the reality of your finances. Is debt just being shifted or are you actually gaining momentum. Now that I have a handy dandy net worth sheet, I might want to do it more often too!