What Is A Sinking Fund And Why Should You Have Them?

Sinking Funds are funds that you put aside, each month, in order to pay for something, big or small, that is not in your normal budget.

You can use sinking funds as a way to pay for yearly expenses and big or small items that you want or need. They save you from borrowing or charging, to pay for things, so you can live debt free.

What Is A Sinking Fund?

A Sinking Fund is money, set aside each month, for a particular thing so you have the money, when you need it. Generally, sinking funds are used for things that are not in your normal budget. It’s kind of like savings but with a purpose.

For example, if you pay for car insurance once a year, instead of monthly, you would set aside 1/12th of your projected insurance amount each month so you have the money, when insurance is due.

Why would you do that, though? Why not just pay your car insurance every month? You may receive a discount, for paying by the year, saving you money! Of course, if you aren’t prepared for that large yearly sum and end up using a credit card to pay, it won’t help out your bottom line. That’s why you save the money, each month, in a sinking fund so you ARE prepared and get the discount, too.

You can start sinking funds for just about anything, big or small. Want a new television? Start a sinking fund. How about a new car? Perhaps you’ve had your eye on a new phone or want to take a family vacation. Sinking funds can be used for anything your family has agreed to save for.

The most common sinking funds are a $1,000 Emergency Fund and Christmas Gifts.

Who Should Have Sinking Funds?

Anyone who pays irregular bills or wants to buys things that are not accounted for in their regular budget, should have sinking funds.

Even small children will create their own sinking fund by saving money, in a jar, for a toy they really want.

Sinking funds can be used along with the family budget or by individual family members, using their allowances.

When Should You Start A Sinking Fund?

You should start a sinking fund as soon as you have an expense or item you need to save for that isn’t in your regular budget. A good place to start is with an emergency fund.

It is okay to have more than one sinking fund but you might want to limit the wants sinking funds to just a few. For example, if you want to purchase a new phone and a laptop, it would be best to decide which one you’d like first, and save for it, before you save for the other.

Why Should You Have Sinking Funds?

Sinking Funds PREPARE you to pay for things you want or need.

You should have sinking funds to:

- Eliminate Stress

- Be Proactive

- Control Where Your Money Goes

- Be Prepared

- Get The Things You Want

How Do Sinking Funds Work?

Sinking funds are used to set aside money so you have it when you need to pay a particular bill or purchase a predetermined item.

- Determine how much you would like to save for your Sinking Fund.

- Decide WHEN you’d like to have the total amount saved. For example, if you are saving $1,000 for your $1,000 Emergency Fund, you may want to have it saved in three months.

- Divide your saving goal by the amount of time you have to save. In the example, from above, your equation would look like this: $1,000 ÷ 3 = $333.33/month.

- Make your Sinking Fund a part of your monthly budget. If you would like to save $1,000 in three months, you need to incorporate $333.33 a month into your spending plan.

Once you have your initial sinking fund saved, you can move on to more sinking funds that work for you.

Where Should You Keep Your Sinking Fund?

Where you keep your sinking funds will depend on the sinking fund’s purpose.

If your sinking fund is huge, you will want to be sure to keep it in a safe place, like a bank. If your sinking fund is small, you could probably get away with keeping it at home. It may be beneficial to do a combo of both, saving at home as you earn cash, and then depositing at the bank.

We don’t suggest keeping thousands of dollars, at home, in envelopes. That’s not safe.

- Many people like to keep their sinking funds at online banks, where it takes a little work to get to them.

- Some may open multiple bank accounts for each sinking fund they have.

- Others will keep their sinking funds in one bank account and have a spreadsheet that tells them what the money is designated for.

- Even still, some choose to keep small sinking funds at home.

Personally, we keep our small $1,000 emergency fund, in our checking account, as a buffer. The experts will tell you NOT to do this because it’s too easy to get to. Our little trick is to deduct the $1,000 from our balance so we don’t see it. Then, we don’t have to worry about a zero based budget and taking our checking account down to nothing. We’ve got a cushion.

For larger, ongoing sinking funds, like college expenses, we have a designated account to move money into, until tuition is due.

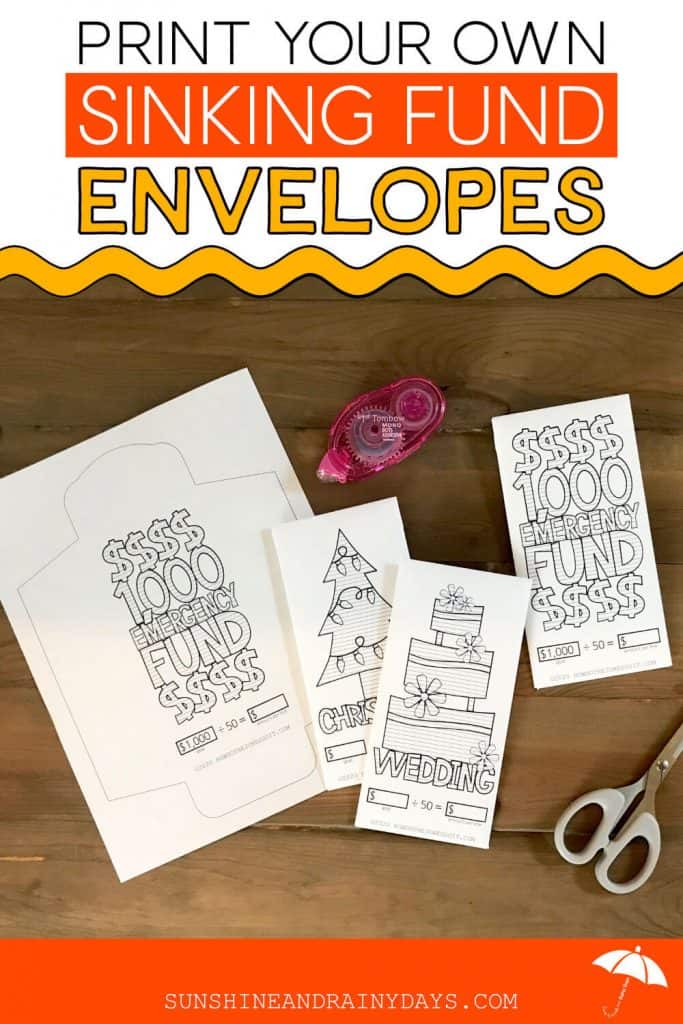

If you are saving for something small, you may choose to keep a sinking fund envelope, right at home.

How Do You Stay Motivated, While Building Sinking Funds?

Sinking Fund Charts and Sinking Fund Envelopes give you an excellent visual to help keep you motivated and on track to save!

Write your goal amount and divide by the number of lines you have so you can color in the lines, as you save.

Sinking Fund Charts

Sinking Fund Charts can be hung on the fridge or wall for a great reminder of what you’re working for.

Sinking Fund Envelopes

Sinking Fund Envelopes are a great place to stash the cash and track your progress, all in the same place!

What Are The Benefits Of Using Sinking Funds?

- Sinking funds help you breathe easier, knowing that future expenses are planned for and won’t put you in debt.

- Sinking funds allow you to goal set and SAVE for the things you really want.

- Sinking funds keep you from using your emergency fund to pay for things because you have the cash.

- Sinking funds help you to avoid interest charges on credit cards since you won’t need to charge.

- Sinking funds give your money a purpose and helps you stay on track.

Sinking Funds are an excellent TOOL to help you save for yearly expenses or things that you want!

Sinking Fund Resources

To help you track your sinking fund savings, check out: