How to Live on a Once a Month Paycheck

It was a shock to our budget when my husband started working in public education and payday only came once a month. His once a month paycheck was automatically deposited into our account on the first of the month and we had to have our ducks in a row to make it through the entire month!

How To Live On A Once A Month Paycheck

Learning to live on one paycheck a month was challenging, at first. We would often find ourselves with a lot of month left but no money. We had to learn to set aside money, to pay bills that came in throughout the month, and work within our allotted amount for groceries.

1) Use The Ledger System

The ledger system makes it super simple to see, at a glance, which bills will be coming in for the month.

- Purchase a 12 column ledger – These can be found in office supply or even drug stores. You can also purchase one here. I prefer the ledger simply because it lasts many years and is easy to keep track of, however, I have created simple PDF files for you to download, if you prefer. You will find them in our Budget Binder!

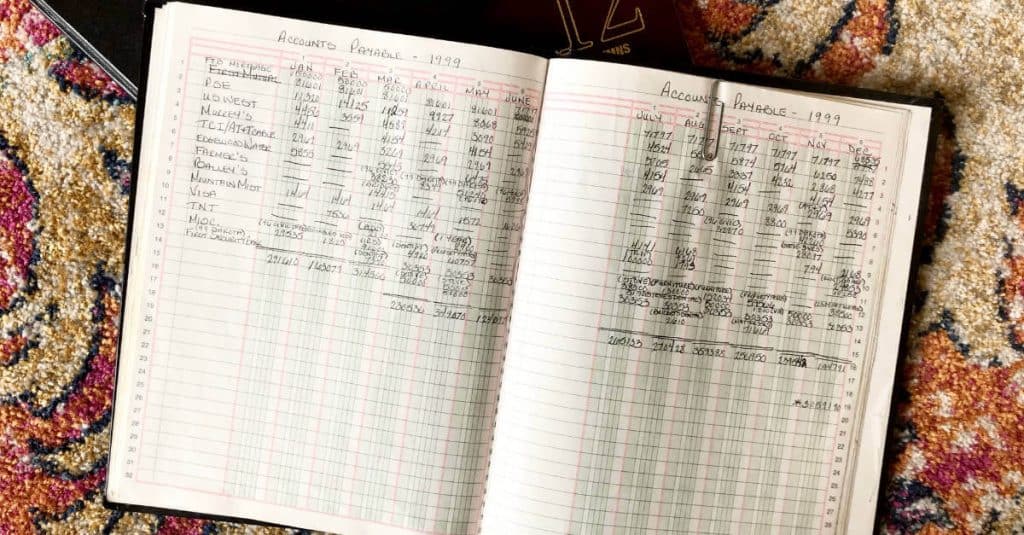

- On the first two page spread, head it ‘Accounts Payable – year’

- Write normal monthly expenses in the left column

- Head the additional 12 columns January – December

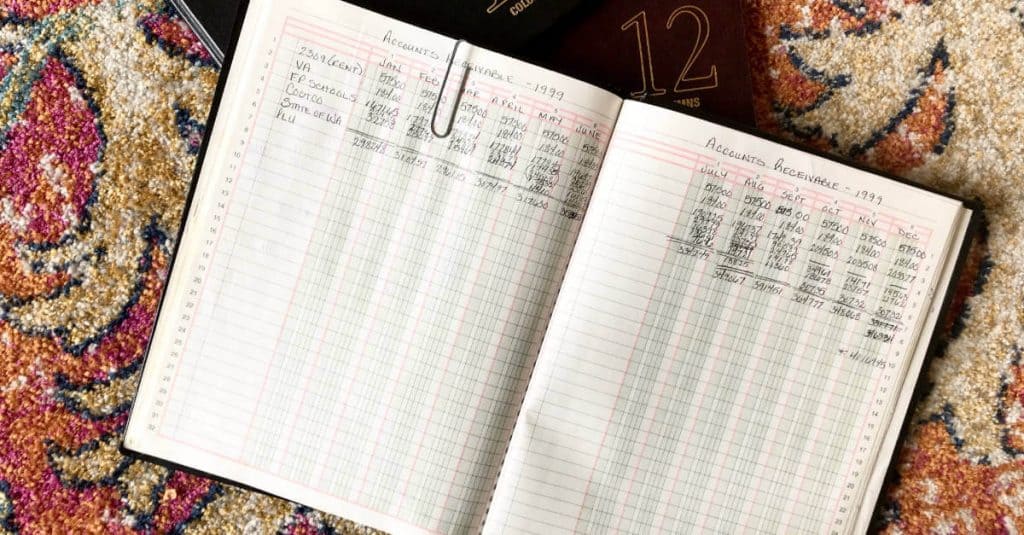

- Turn the page and head it ‘Accounts Receivable – year’

- Head the additional 12 columns January – December

- Write in every source of income in the left column – This may include the IRS if you usually receive a refund.

2) Record Your Income

Each month, record the amount of your paycheck in the corresponding month of your ledger AND in your checkbook register. Yes, I STILL use a checkbook register and believe it’s a good way to track the money in your bank account.

3) Pay Your Current Bills

At the beginning of every month, pay the bills you have received and write them in your check register AND in the ledger.

4) Pay Bills That Are The Same Amount Each Month

Your car payment may not be due until the 20th but you know the amount. Go ahead and pay it, or at least schedule it, in your online banking along with all other bills that are the same each month. Record in your check register AND ledger.

5) Check Your Ledger For Remaining Incoming Bills

This is easy to do because all of your regular bills are listed, in your ledger. If you haven’t already paid it, it will be blank, so you’ll know you still need to pay it this month. You probably have an idea of how much your remaining incoming bills will be. Add up the amounts and subtract it from the amount in your checkbook register (no need to write it in) to see what you have left to work with.

6) Write A Check To Cash For Allowances And Expendables

We are big proponents of allowances! It goes a long way to have a little personal cash to spend.

Expendables are anything you can pay cash for, throughout the month. Groceries, pet essentials, etc. It will take some practice making sure your grocery money lasts throughout the month. One way to do this is to split up your expendable cash and put it in cash envelopes, for each week. We tend to shop heavy at the beginning of the month and then maintenance shop the rest.

7) Add To Savings

Ideally, there will be enough left in your budget to add to your emergency fund, Roth IRA, etc. Hopefully, you have already invested in your retirement program through work.

8) Leave A Cushion In Your Account

Many people talk about a zero based budget. This is where you budget every dollar and don’t leave money left to spend on unplanned purchases. Of course, it isn’t best practice to take your checking account down to zero. We like to leave a $1,000 emergency fund in our checking account, to avoid any issues. I ‘hide’ that money in my checkbook register so it doesn’t look like we have it. That just means the $1,000 isn’t in our balance. Instead, I take note of it at the top of the register. It’s a mind game!

9) Your Checking Account Is Now Closed For Business

At this point, money from your checking account shouldn’t be used for anything other than the bills you know will be arriving. If you don’t like using a cash system for groceries, etc., it may be good to open a separate account just for those items!

10) Make End Of Month Calculations

At the end of the month, add your payable column and write your total expenses for the month, at the bottom. Do the same for receivables. Subtract your expenses from your income. Did you live within your means?

Sixteen years later, I couldn’t imagine payday being any other way. I must admit, the end of the month can still be a challenge to stay on budget but I love the once a month paycheck! I can sit down and pay the bills all at once (except for the few stragglers) and we know exactly what we have to deal with. It is a simple, straight forward, process!

Excellent ideas, thank you. My husband passed away a few months ago and with that his social security income ended as well. Our savings/investments were wiped out in the months preceding his passing attempting to save our daughters life. She passed on the day of my husband’s funeral.

My social security is too little to cover my basic monthly needs, let alone food, medication, etc. To even consider $1.00 a month for savings is not an option. I have to alternate months to pay utilities, not pay property taxes in May (I use the refund check to pay half the year), and I am running out of things to sell.

For the first time in my life I applied for benefits through the government, but sadly I make about $30.00 a month too much from social security so that was a no. I am sick and unable to work.

I have to sell our home. We own it free and clear, but it needs so many repairs…I do not have the money. There is no one I can borrow, nor any programs available to help. I’ve exhausted every possible option. The only thing I can do is sell it as is, for a fraction of the value, and move into a rough area with inexpensive rent.

I’ve worked hard my entire life, as did my late husband. Not once did we see any of this coming and truly believed our $600,000.00 retirement nest egg was enough. His passing was unexpected. I would do it over again 10 fold to attempt to save my daughter’s life. I am just unsure about what the future holds. I am unable to take my medications…have Medicare Part D so am not eligible for any programs to assist with medications required to maintain living with this disease.

I am not looking for sympathy or suggestions. Trust me, raising 4 kids on minimal income, I’ve mastered the art of budgeting and getting by on minimal. For over 40 years, I am proud to say my children never went without. They may not have had the name brands, but the had nice, clean clothing, food, received an education, had shelter, lots of love, and were able to participate in sports, etc.

The purpose of this post is to simply beg all of you to know life can throw you a curveball and there isn’t always a solution. Our government is not there to help, even though I paid in for many years.

I will be selling my computer and giving up the Internet next. I can use the $150.00 for bills. I still owe roughly $14,000.00 for two funerals. I used the memorials to pay the other $10,000.00 due. Even though my daughter was receiving (periodic) benefits from the county at the time of her passing, what they covered was minimal. A county burial consisted of a cardboard casket (you can literally push on it), no sealed vault leaving her body open to all critters and elements, no flowers and very limited allowances for clergy and funeral home. Nothing else was allowed…even gifted by others. There was a $500.00 cap that could be spent towards clergy, etc. I understood this was her vessel and her spirit was no longer using it, but I gave birth to that vessel and could not subject it to the horrors that a county burial would provide. I cannot imagine any one of our government officials allowing someone they love to have to be buried like this. Shame on them for expecting it from us.

Thanks for listening. I am hoping no one ever has to experience living like this. My personal hell is not my limited finances, but living without my husband of several decades and my daughter. I don’t care anymore about my needs. Our government doesn’t…clearly.

Yes, I have three other children and I am thrilled to say one is loving and caring. If she knew how dire this was, she would move heaven and earth to help. She has young children of her own and a husband. I will NEVER be a burden to her. I am ashamed to say my older two are selfish and want nothing to do with me. They are my step children, whom I raised as my own from the time they were 8 and 9 years of age. They’ve stolen about everything they could have from both my husband and me, as well as my husband’s late parents. They are very good at lying and playing the victim role in that their childhood was rough (their mother was an addict and a manipulator who got everyone to pay for her needs (including us). These traits sadly have been passed on to her children as well. I will still do anything to help them should they need. I love them dearly, but have been told, by them, to leave them alone. They are planning on suing me for a portion of the house proceeds when it sells. My step daughter sued my husband for control over his parents estate after they passed. I know they will break in and try to steal whatever assets are left so I cannot leave my house for any length of time. They broke my husband’s heart and I truly believe they played a part in his early passing. The guilt they felt was obvious as we disconnected life support at the hospital. It hurt to see them in so much pain so I did what was possibly the wrong thing to do? I told them to forgive themselves and I lied, saying their dad forgave them. I do not want them to be miserable…although I don’t think either one is. That brings me some peace.

Thanks for hearing me out…

I get a paycheck once a month and have since I began getting a professional paycheck over 30 years ago. I am an academic scientist- when I finished college and went to grad school in 1981, I received my stipend monthly, and because I have stayed in a university/hospital academic setting that has been the way I have been paid ever since . I have never had an actual budget. I am just frugal by nature and never buy what I don’t really need or have enough disposable income for. I have money automatically put into saving (for an emergency fund as well as for my two kid’s college account) and retirement, and I have all my bills paid automatically from my bank account as well. I do check on the account now and then, but everything is pretty much on autopilot!

Wow! Sounds like you have an awesome system going, Monica! I’d like to do the automatic emergency fund and college account and I need to look into the bills being paid automatically. It makes me a tad nervous though. You have a very interesting job!

Payday comes once a month at our house and I find it is so much easier than when my husband got paid twice a month. We have been budgeting this way for about 20 years now and it so much easier.

I so agree with having a cushion of those unexpected bills that can come up. Great Post!

Sounds like we’ve both been in the same boat for a while now Shelly! I agree … once a month paychecks simplify the budget! Thank you so much for stopping by!

I found this post by visiting the Frugal Friday Link Up Party. My husband receives one disability check every month and I get paid bi-weekly. It sucks we never have any money. 🙁 Thanks for a great post!

Oh, Janell … I hope things start looking up! It sounds like you have quite a few checks coming in! I’m so glad you found us through Frugal Friday!

Wow!!! I would LOVE to adapt this system as I feel like I spend way to much time trying to manage money that comes in and goes out. Unfortunately, my husband works for himself and gets paid as he finishes jobs – anywhere from multiple times per week to once every three weeks!

Holy Cow! That must take some real practice to figure out Sarah! This system is super simple and straight forward!

My hubby actually gets paid once a month and it took a few months to get used to it since he gets paid mid month and most bills are due at the beginning, but now we love it because it seems so much easier to manage with a budget.

That is interesting to be paid mid-month with a once a month paycheck. It must take some self control! I totally agree … it makes managing the budget much easier!

Mr. Frugalwoods and I are both paid bi-weekly and always have been, so, we’ve grown pretty accustomed to it. We both have our paychecks direct deposited into the same account, which makes bill paying fairly straightforward.

Direct deposit is so efficient! I guess we’ve had it so long, it’s hard to imagine a paper check … do people still get those?! It sounds like The Frugalwoods have an awesome system set up! I knew you would;0) I’ve been enjoying your blog!!!

I’ve always been paid bi weekly, but Jim has a monthly paycheck. I think regardless of when you get paid, as long as you track your expenses and don’t go hog wild when the check comes in, you’ll do fine. I imagine it would be hard to go from bi weekly to monthly at first, but OK once you get used to it.

It sounds like you have the best of both worlds Kim! That’s awesome! It was a little hard adjusting to one paycheck at first but we really like it now!

I’m always impressed by those living on a once a month paycheck. We do something similar as far as tracking with an Excel spreadsheet. Seeing what’s due and when at a simple glance really does help for better accounting.

Isn’t it great it can be so simple to budget instead of some huge elaborate system?! I just love simplicity! It makes it easy to see when tabs will be due, etc.! Thank you so much for stopping by Laurie! I enjoyed learning more about you on the ‘crush’ post;0)

I’ve always thought a monthly paycheck would be so much more simple than biweekly for these same reasons!

It is super simple Sarah! We just have to plan ahead so we can buy groceries at the end of the month without charging! I listened to your interview this morning! You did awesome! What a great opportunity!!!

I’ve experienced both; monthly for the 21 years I spent in the Army and bi-weekly for the last 9 years. I prefer bi-weekly.

I have noticed from reading American blogs that bi-weekly is the norm for payment. In the UK, most people are paid monthly and most bills (rent/utilities) are monthly. Automated payments (direct debts/standing orders) is the way to go.

You are right Victoria! Bi-weekly is the norm … it’s interesting to hear how things are done in the UK! Our rent/utilities are also monthly. I don’t do much automated unless it is through credit … like the security system. I’m not quite ready to give up that control;0) I do pay bills online though which is super convenient!

Having some type of system – you mention a ledger – that allows you to track and adjust, is a must. Great point. The only difference for me is number seven (Add to Savings) would be number two.

“How many paychecks do we receive each month?” Between my active duty retirement check and our current jobs, which pay every two weeks – 26 times a year – it works out to five times 10 months of the year and seven times the other two months.

That’s a whole lotta paychecks! You sound like you’re rolling in the dough which makes it super easy to make ‘add to savings’ #2;0) We do invest 10% (with match) in the hubster’s work plan before we even see the check which helps! Building the emergency fund needs to start moving but it’s hard to think about saving money when you’re paying interest on credit.

True, a significant income makes it somewhat easier to save. However, I’m a firm believer in the maxim, “It isn’t what you make, it’s what you do with it.” It is all about habits. Even if someone does not have a significant salary, they should develop the habit of paying themselves first, even if it is only $25/month. Better to have entrenched habits once you do make more money vice trying to learn at that point.

“…it’s hard to think about saving money when you’re paying interest on credit.” Absolutely! Credit, and the debt that is often the result, is pure evil.

Right now, I agree credit is pure evil! I do enjoy the perks when we can pay it off though. Somehow, about once a year, we tend to get behind which negates those perks.

It’s true … anyone can save $25/month!

I receive paychecks bi weekly, but since I have 2 jobs I get 2 paychecks every 2 weeks. It’s pretty convenient. I used to get paid every week and wasn’t a huge fan of that.

Holy Cow! That’s awesome Alexis! Sounds like you are working super hard!