House Hunting Checklist

Decisions are agonizing! What house should you buy? How big of a mortgage payment can you handle? Does the home have the right bells and whistles? Is it in the area you desire? If you are ready to Buy A House, you need a House Hunting Checklist to make your options plain as day!

We found the PERFECT house for us! It’s a rambler with the space we need, curb appeal, all the bells and whistles, and an unforgettable view! My daughter and I are ready to call it home! There’s just one issue that my husband can’t seem to overcome.

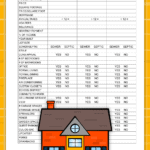

Of course, there will be give and take to any house you look at but you want to make an educated decision based on the cold hard facts. There are the obvious facts like the price, square footage, and number of bedrooms and bathrooms.

It’s time to dig deeper and do an analysis of the homes you are considering, side by side.

- What is the difference in price per square foot?

- How big is the lot?

- Is it on sewer or septic?

- Does it have wasted space?

- Does the home have conveniences you are accustomed to such as air conditioning, custom closets, sprinkler system, storage space, etc.?

You may even want to dig so far that you know what percentage of your take-home pay your mortgage payment will be.

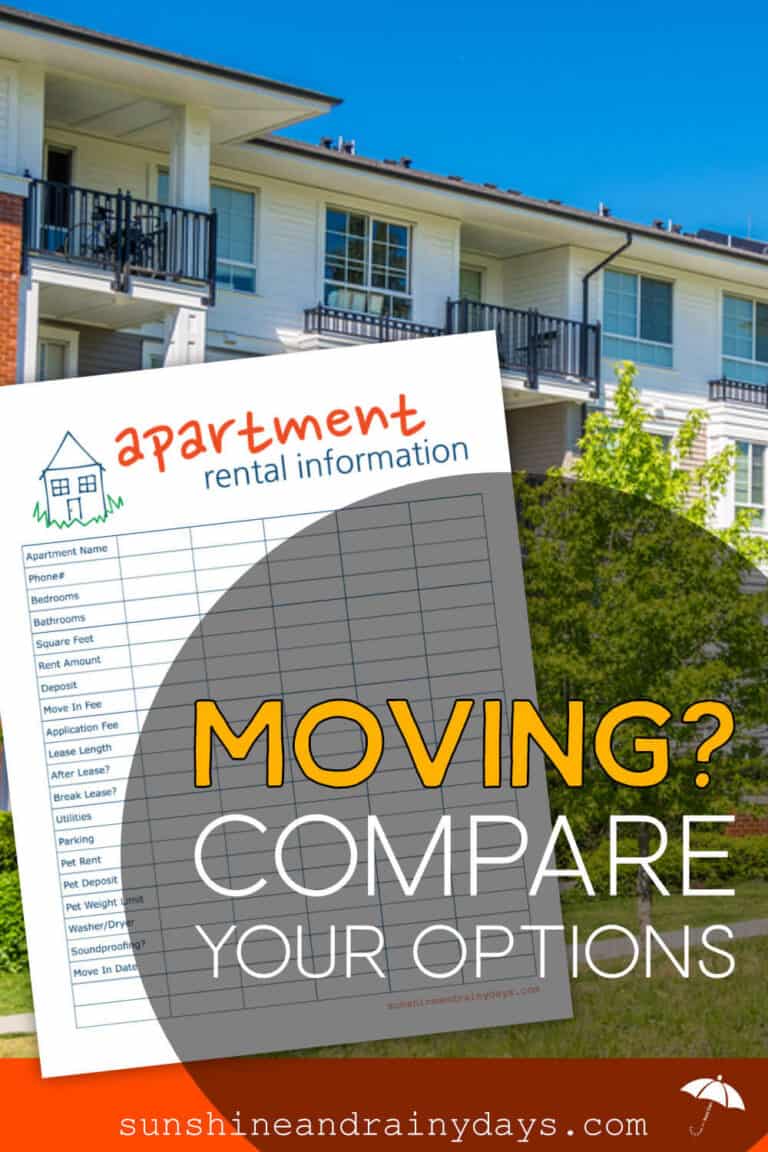

Guess what? We’ve created the House Hunting Checklist just for you!

Get Your House Hunting Checklist Here

The House Hunting Checklist will help you compare up to three houses on one sheet! Looking at more than three houses? Print as many checklists as you’d like.

Most of the information on the House Hunting Checklist can be found in the house listing, on Zillow, and on your tour of the house.

How To Use The House Hunting Sheet

- Print the Checklist.

- As you house hunt, take the Checklist with you.

- When you tour a house that you like enough to possibly make an offer, fill out all of the information you can, right there and then, before you forget.

- Once home, check out the listing to fill in the rest of the house’s information.

- If needed, check out Zillow for additional information.

- Repeat for additional houses you may want to call home.

- Compare the information of each house to determine which house makes the most sense for you!

How To Calculate The % Of Income Your Mortgage Payment Will Be

Back to that perfect house. My husband can’t seem to overcome the fact that the house payment would be a whopping 44% of our take-home pay! Oy vey!

According to Dave Ramsey, your total mortgage payment, including tax and insurance, should not be more than 25% of your take-home pay. He also suggests a 15-year fixed-rate mortgage!

To figure what percentage of your take-home pay your mortgage costs will be, check out this handy dandy calculator! It will show you how to do the math AND do it for you! Win!

If you’re a mathematician and want to figure it out yourself, the equation looks something like this:

100%/X%=take home pay/total mortgage payment

I would do total injustice in teaching you how to solve that equation but the link above does a swell job helping you out with that!

Here’s a quick summary:

- In the second set of boxes, on the handy dandy calculator, enter your take home pay in the first box.

- Enter your estimated mortgage payment in the second box.

- Click Calculate.

- Scroll down to see the math and your percentage!

For example:

If you typed 2700, in the first box, as your estimated mortgage payment, then $9,000 in the second box as your take-home pay, you would end up with 2700 as 30% of 9000.

But What If You Just Want To Figure Out What 25% Of Your Take Home Pay Is?

That’s easy! You can use a calculator to figure that out. Just enter your take-home pay and multiply it by 25%.

Using the take-home pay from above, your equation would look like this: $9,000 x 25% = $2,250.

That means, to stay in Dave Ramsey’s guidelines, your mortgage would not be more than $2,250 with a 15-year loan. I have to say that’s tough to do and we aimed for 25% of take-home pay with a 30-year mortgage.

You can also use the link I shared above to determine this amount by using the first set of boxes.

- In the first box type in 25.

- Enter your take-home pay in the second box.

- Push Calculate.

- Scroll down to get your answer!

Hi we are both trying to get out of debt and then start budgeting and then building up wealth for the future.

Would be great if it be printed in black & white

Hi Susie! You should be able to tell your printer you want to print in black and white! Let me know if that works for you!

Oh my my my my my my my. Ouch. I love your checklist! But, my my my, um, I’m feeling Steve’s pain! :O But I’m happy for you! 😀 Yep, conflicting messages there, huh? 😛

Lol! Don’t worry, Kay! We haven’t been successful at convincing Steve to make that 44% of take-home pay house ours. Although, we just found out his new job is coming with a heftier raise than previously anticipated! That brings the number closer to 34% – perhaps we can work a better deal and make it happen? Maybe you should worry!

I think that’s a reasonable number. 25% would be nice, but may not be feasible for getting the perfect home for your family. Best wishes Bridget! 🙂

I’m telling Steve you said it’s a reasonable number! TeeHee! Thank you for the good wishes!

THAT is a pretty big thing to overcome. And kudos on the house hunting checklist.

We have moved a lot. A lot. When we first moved to Tennessee, we both knew exactly what we were looking for in a house. We had both grown up close by the town we’d moved to, and so we kind of “knew” the market without knowing it. We picked out 5 houses that met all our criteria, looked at them, and put an offer in during the first day. Easy on the Realtor!

But the other areas we have moved to have a very different market. In Houston, lot sizes were really small. The house might be OK, but the lot often broke the deal. When we moved North, the age of the homes just killed me. Most of them were also on really small lots. And in New England, we found that the age of homes was a continuing issue.

But one thing we have never compromised in is what our dream home really is. We only ever had it in Tennessee. But every time we start looking, we use that as a place to start. We ask the Realtor to counsel us on what things we might have to give on (like – I want 2.5 baths, but 0.5 baths are rare in old homes). And what things might be available, but just not in our price range. A good realtor will definitely help you meter your expectations before you go house hunting. One that doesn’t is hoping that they can show you a home well outside your price range and still have you say yes! Run away!

Whew! You were super easy on the Realtor in Tennessee! We have a few Realtors we can go to if needed but, so far, have looked on our own! We have a very small area we are looking at and have kept ourselves very aware of what’s going on there!

It’s so true that different areas have different markets, even within 30 miles of each other. We are hoping to buy in an area where homes are on tiny lots but are looking at it as a reprieve from the huge amount of yard work we do now!

Now, to just find a home that is closer to 25% of our take-home pay!